Makes working life easier

Efficient, friendly and effective. Helpful & responsive when the occasional need arises!

You’ve decided to work for yourself. That’s the easy bit.

What trips people up is everything that comes after. HMRC, tax, names, websites, compliance. No one tells you what actually matters first.

You Google it. One article says register immediately. Another says wait. Checklists are long, conflicting, and impossible to prioritise.

So the visible stuff gets done first. Logos. Social profiles. Maybe a website. The important admin is delayed or done incorrectly.

Then you start earning money and realise you’re not sure if you’re set up properly. Deadlines approach. Uncertainty creeps in.

We get you registered

You give us a few details. We register you with HMRC as a sole trader and reserve your chosen company name at Companies House for future use. You’ll receive your UTR and confirmation you’re set up properly.

We set you up (48 hours)

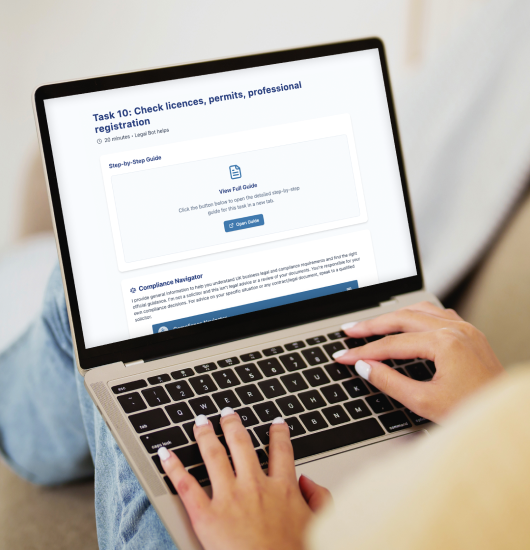

Your domain, business email, and website are set up and published. Your dashboard is ready, showing your first tasks and where to get help if you need it.

You follow the 12 week plan

You work through a clear set of steps covering:

The Marketing Hub and AI assistants guide you as you go. One thing at a time. No guessing.

A clear plan covering the core admin and early marketing tasks every new sole trader needs. One legal task and one growth task at a time.

Get set up properly

At the same time:

Stay compliant, start earning

At the same time:

Build the system

At the same time:

Our checklist covers the essential setup and compliance steps every new UK sole trader needs in their first year. If something important is missing that we agree should be included, we’ll refund our service fee and you’ll keep full access for the full 12 months.

This doesn’t cover industry-specific requirements or bespoke tax or legal advice.

Doing it yourself

Paying professionals

Included in the price

HMRC registration (UTR)

£0 + risk of mistakes

£100–200

Company name protection

Not possible

£100–150 per year

Domain + business email (12 months)

£30-50

£50-100

Website

£150–300 + your time

£800-2,000

Help with tax and admin questions

Google (30+ hrs)

£150/hour

Help finding customers

Google (40+ hrs)

£2,000+ coach

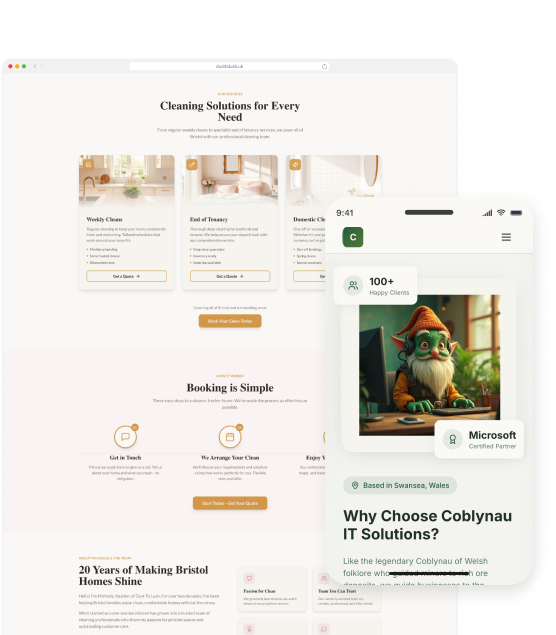

A professional website set up quickly so you can start trading with confidence and look credible from day one.

If you already know what you’re doing and just need HMRC registration, we offer a registration-only service.

£197 upfront gets you registered with HMRC, your business website live, and your company name protected for future use. Plus a clear 12-week plan and ongoing support, so you always know what to do next.

One thing at a time. Help when you need it.

Takes about 5 minutes. No commitment until you're ready.

Most first-time sole traders have too much to do and no clear place to start. This fixes that. £197 today. One thing at a time. Guidance when you need it. And a clear path to move forward, without guessing.

Looking for registration only? We offer a standalone option for experienced sole traders, costing £53 .

If you need a little advice on the best options for you, or have a question that's not in our FAQ, Duport's expert team are here to help. Give us a call during office hours or email us any time and we'll help you out.

Still have questions? Here are the answers to some of the most common questions people ask about Sole Traders.

Yes. If you already know what you’re doing and only need HMRC registration, we offer a registration-only service for £53. It doesn’t include guidance, name reservation, a website, or ongoing support. Most first-time sole traders choose the full package because knowing what to do next is usually the harder part.

Sole Traders are always self-employed. But not all self-employed people are necessarily Sole Traders, although it is by far the most common company structure for self-employed people.

Being self-employed means that you don’t get paid by PAYE, and actually take your income through self-assessment.

A Sole Trader is the company structure used when you and your business are considered the same entity for legal and financial purposes.

So, technically you can be self-employed and run a Limited Company or a Partnership, but most self employed people are also Sole Traders.

All Sole Traders are self-employed, so it’s absolutely possible to be both at the same time. You can also be in different types of employment or self-employment at once.

So if you are a salaried employee, but also have a sole trader business, you can be both employed and self-employed at the same time - you just need to make sure you’re including it all in your self-assessment!

If you are the only person running your business, you are happy to be personally responsible for your business debts and liability and you don’t want the hassle of extra paperwork and regulations then this could be the best choice for you.

There are no age restrictions for Sole Traders, but if you have previously been declared bankrupt you may need to get permission from the courts to set up your business.

To register your Sole Trader business you will need to provide the following details:

You will not need to provide any proof of ID.

Sole Traders don’t need to have a separate bank account, as your business earnings are considered your own personal income.

However, things can quickly get complicated if you’re running your personal and business finances from the same account, so we highly recommend setting up a separate account for the business.

If you register with Duport, you can get a free business account as part of the process.

Sole Traders have a lot less paperwork to complete than Limited Companies, but you will need to complete your Self Assessment Tax Return each year.

If you don’t want the hassle of doing your own bookkeeping and accounts, Duport can handle it all for you with our Sole Trader Tax Return service.

When you register as a Sole Trader, you don’t automatically get any protection for their business name.

However, Duport have a Protected Name package for Sole Traders that means your business name is also registered at Companies House, to prevent anyone else trading under it.

Yes, you do not need to be in the UK in order to register as a Sole Trader.

You can cancel your order at any point. Refunds will only be issued if you have not accessed any of your purchased services.

Your right to a refund is waived if:

Your initial registration is a one-off service. However your package may include services that do need to be renewed annually. These can include:

Your Unique Taxpayer Reference or UTR is the number that HMRC uses to identify you as a self-employed person. It’s what you will need to use to submit your Self Assessment Tax Return.

Our Sole Trader packages aren’t suitable for you if: