The problem

You've done the hard part. You've decided to start. Most people talk about it for years and never take the leap. But knowing you want to start a business and knowing what to do next are two different things. There's too much to do and too many places to begin.

You Google it. One article says register for VAT immediately. Another says wait until you're earning £90,000. You find a checklist with 33 items and no idea which ones matter.

So not enough gets done. Or the easy stuff gets done (tweaking the logo, updating LinkedIn) while the important stuff waits.

Meanwhile, deadlines don't wait. Miss your confirmation statement (the annual company update you send to Companies House) and there's an automatic £150 fine. Keep missing things and your company gets struck off.

How it works

-

1

We form your company (24 hours)

You give us your details. We handle Companies House. Your official documents usually arrive within a day.

-

2

We set you up (48 hours)

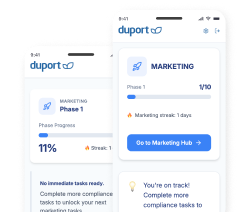

Your domain, email, and website go live. Your dashboard is ready, showing your first three tasks.

-

3

You follow the plan (12 weeks)

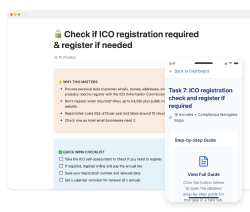

Each week, you get one legal task and one marketing task. We provide the scripts and templates. You just hit send. AI assistants help you understand the legal side. Weekly calls help when you're stuck on anything.

Your 12 week checklist

A clear plan covering the core admin and early marketing tasks every new sole trader needs. One legal task and one growth task at a time.

Week 1-4

Get clear, get set up

- Open a business bank account.

- Register with HMRC (the tax office).

- Set up a simple way to track your income and expenses.

- At the same time: define who you're selling to, write how you'll talk about your offer, and start real conversations with potential customers.

By the end of week 4:

- Bank sorted.

- Tax registered.

- Clear on your offer.

- Talking to real prospects.

Week 5-8

Stay legal, start selling

- Verify your identity with Companies House.

- Check if you need to register for data protection.

- Get your website legally compliant

- At the same time: get comfortable talking about price and ask for your first sale.

By the end of week 8:

- Admin sorted.

- Website compliant.

- First paying customer.

Week 9-12

Build the system

- Complete your data protection paperwork

- Learn how to pay yourself properly

- Set up calendar reminders for all your legal deadlines

- At the same time: build a repeatable system to find leads and close customers two and three.

By the end of week 12:

- Legally sorted.

- Know how to pay yourself.

- Multiple customers and a system to find more.

The Complete Checklist Guarantee

Our task list covers the core compliance actions every UK limited company needs in year one. If you find something missing that we agree should be there, we'll refund our service fee. You keep full access for the full 12 months.

Doesn't cover industry-specific rules or director responsibilities. See full terms.

What it costs

DIY

Doing it on your own

Industry

Paying professionals to do it

What we help with included in the price

Company formation (inc. £100 govt fee)

£100

£150–200

- Included

Registered address (12 months)

£0 + risk privacy

£100-200

- Included

Domain + email (12 months)

£30-50

£50-100

- Included

Website

£150-300 (15+ hours)

£800-2,000

- Included

Help with legal questions

Google (40+ hrs)

£150/hour

- Included

Help finding customers

Google (50+ hrs)

£2,000+ coach

- Included

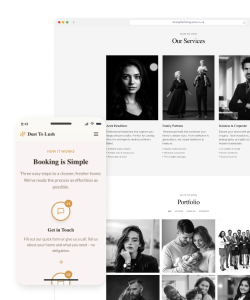

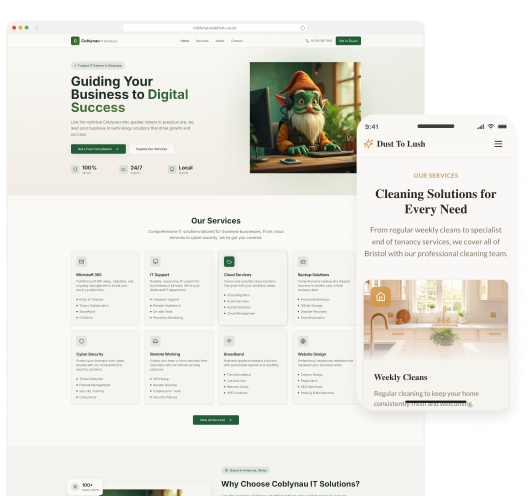

Ready to go website

A professional website set up for your new limited company, built quickly and done properly so you can start trading with confidence.

Who is this for

This is for you if:

- You're starting your first UK business

- You've got too many tabs open and not enough clarity

- You'd rather follow a clear plan than piece it together yourself

- You work better with structure and accountability

This is for you if:

- You've done this before and know the ropes

- You just want the cheapest formation going

- You want someone to do it all for you (we guide, you do the work)

What we can’t do

Ready to know exactly what to do next?

£244 gets your company formed, your website live, and a clear 12-week plan. Renewal is £194 per year after that.

Takes about 5 minutes. No commitment until you're ready.

What you get:

- Company formed at Companies House

- Business address for 12 months

- Website, domain, and professional email

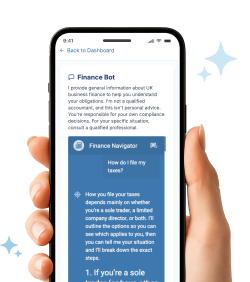

- AI assistants for legal questions

- 12- week programme: one task at a time

- Weekly founder calls

Most first-time founders have too much to do and no clear place to start. This fixes that. £244/year. One thing at a time. Help when you need it.

Need some help?

If you need a little advice on the best options for you, or have a question that's not in our FAQ, Duport's expert team are here to help. Give us a call during office hours or email us any time and we'll help you out.

Popular FAQs

Still have questions? Here are the answers to some of the most common questions people ask about Limited Companies.

-

Because they form your company and wave goodbye. We give you the company, 12 months of business address, a website, professional email, AI assistants, a 12 week programme, and weekly calls. Add that up separately and you're looking at £3,000+.

-

Life happens. The programme is designed for 12 weeks but you go at your own pace. The content stays available. The weekly calls keep running.

-

Like messaging someone who knows UK business rules. Ask anything in normal language. Get a straight answer without jargon.

-

Yes. Weekly 30-minute Zoom calls where you can ask anything, plus our support team during working hours.

-

No. We build it for you based on a few questions about your business. No coding, no design skills, no headaches.

-

We'll contact you about renewing. For £244/year, you keep your dashboard, AI assistants, registered address, domain, and website.

-

We're confident our task list covers what matters. If you find a generally-applicable UK compliance requirement that most limited companies need in their first year, and it's missing from our checklist, we'll refund our service fee (£144).

You keep full access to the service for your full 12 months.